This giveaway is now closed. Thanks for stopping by. The winners are Austin B, Susan, Kelly D, and Kristina E. Congrats!

The tax forms have been coming in, which means we’re already entrenched in tax season. While April 15th is the last day to file, I recommend beginning the process early to ensure you’ve gathered all of the information necessary to thoroughly complete your return. But should you do your own taxes or hire an expert? For years we e-filed our own returns using an at home software program like H&R Block, and always found the process to be seamless. And now that we live in a highly digitized age, filing your own taxes can be as easy as downloading and filing via a mobile app!

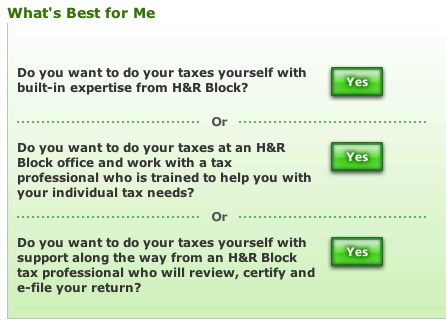

This year, H&R Block introduced a series of tax preparation products designed to personalize at-home preparation and offer taxpayers easy ways to file on-the-go. Whether you prefer to file online, in an H&R Block Tax Office, or with the assistance of a tax professional via video conference, H&R Block has a solution that will fit your needs and lifestyle. Depending on your tax situation, you may even be able to file for FREE! Simply visit H&R Block’s website and take a short quiz to determine which solution would be optimal for you.

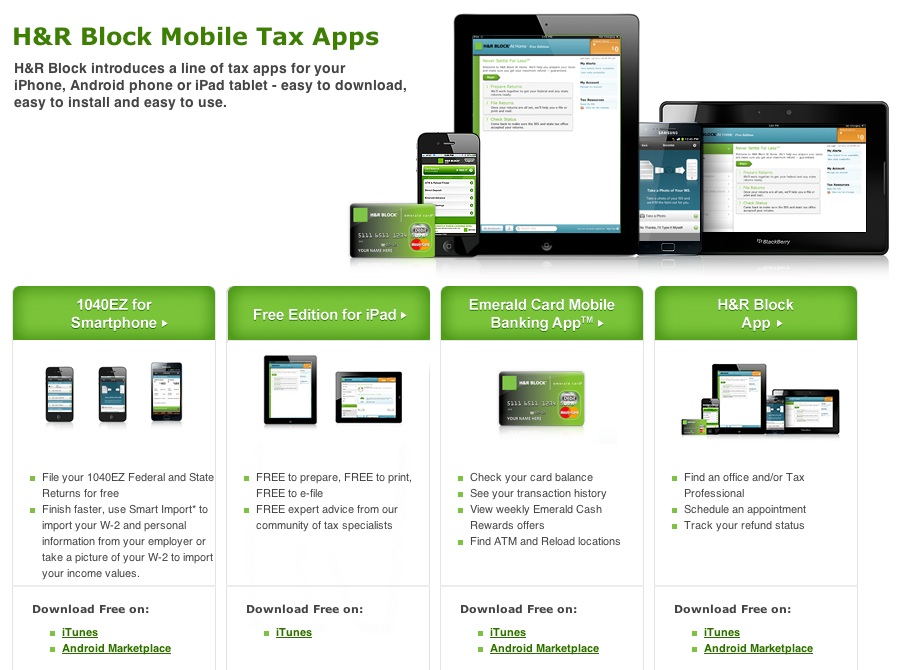

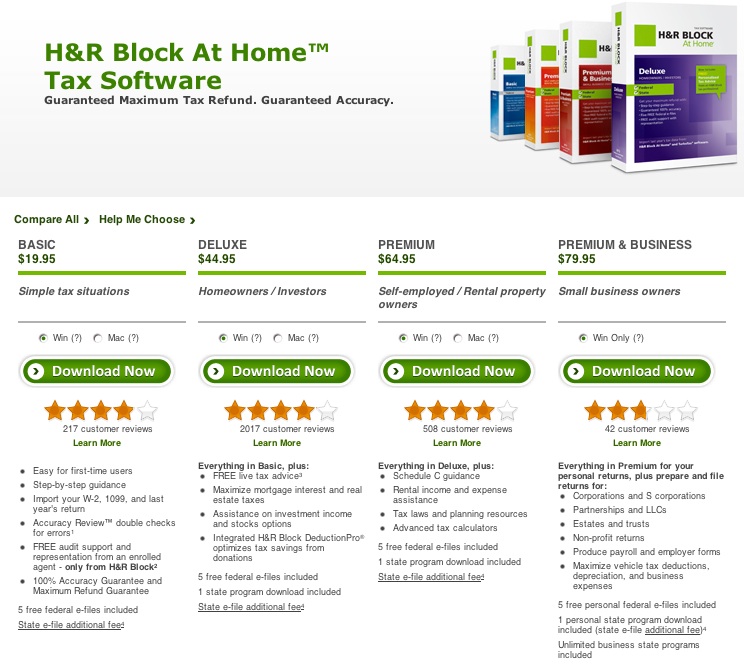

Whether you opt to do your own taxes at home or utilize a tax professional, H&R Block offers several valuable resources to help you prepare your taxes without error. Here is a brief overview of their mobile tax apps and at home software:

Some of the changes you’ll find with this year’s new H&R Block at Home products include real-time tax advice offered by a registered tax professional, Deduction Pro, a popular tool used to calculate the value of charitable deductions, and a condensed interview based on information from a prior year’s return for those who have used H&R Block to file their tax returns. One of the most attractive things about H&R Block’s products and services is that they are backed by the expertise of The Tax Institute at H&R Block and guarantee the maximum refund (isn’t that what we’re all hoping for?). Below you’ll find information on how you can win one of four H&R Block At Home Premium Services. But before you file, what do you need to know about the changes implemented this year?

The IRS announced a delay – The IRS began processing e-filed returns on January 30, eight days later than expected this year. There are a few forms that the IRS will not update until February or March, but 98 percent of taxpayers’ returns can be processed beginning January 30.

Payroll tax holiday has expired – While it doesn’t impact your tax return, it certainly may affect your everyday financial decisions as 160 million American workers will see their take-home pay decrease. The 2-percent payroll tax holiday, which amounted to an automatic raise for workers in 2011 and 2012, expired at the end of the year. So, if you earn $50,000 you have probably seen a $1,000 decrease in your take-home pay over the course of the year.

Millions may be eligible to claim casualty losses – Victims of Hurricane Sandy may be able to claim a casualty loss for any damages not covered by insurance. Claiming a casualty loss as an itemized deduction could mean significant tax savings for millions of taxpayers. Losses in a federally declared disaster area in 2012 can be claimed on either an amended 2011 return or a 2012 return.

Energy credits have been extended – Taxpayers may claim energy-efficiency credits for up to 10 percent of the cost of eligible home improvements, such as energy efficient windows and doors or insulation, with a maximum lifetime credit of $500. If taxpayers already claimed credits equal to or greater than $500 in previous years, then they cannot claim the credit on a 2012 return.

Education credits extended – The American Opportunity Credit was extended through 2017, allowing taxpayers to claim up to $2,500 for each of the first four years of college for each student. Through 2013, the Tuition and Fees Deduction provides a reduction in taxable income of up to $4,000. The Lifetime Learning Credit is worth up to $2,000 per return for post-secondary degree programs. These education benefits cannot be combined for the same student, so taxpayers should choose the one that is most beneficial. Also, with today’s average college graduate having more than $25,000 in student loan debt, they should remember to deduct student loan interest.

Health care reform – 22 million consumers will be impacted by the Affordable Care Act, which is the biggest tax code change in more than 20 years. Filing a 2012 tax return may make it easier for many individuals and families to enroll in health insurance through a government sponsored exchange beginning October 2013. It’s important this tax season to learn about what tax benefits may be available to you and your family to help cover the cost of health care, and H&R Block can help.

Whether you plan to file from your smartphone, iPad, computer, or at a tax office, H&R Block can help streamline the process with its tax products and services. I highly recommend visiting the site where you’ll find everything from tax calculators and tips to filing resources, support, and more.

Win It! FOUR of you will win H&R Block At Home Premium! Simply leave me a comment telling me one thing you learned from the site. Comments will close on March 15th, 2013 at 11:59 PM PST.

Win It! FOUR of you will win H&R Block At Home Premium! Simply leave me a comment telling me one thing you learned from the site. Comments will close on March 15th, 2013 at 11:59 PM PST.

US Residents only. Duplicates and comments not including the above information will be disqualified. Comments are moderated. If you don’t see your comment in a reasonable amount of time, send me an email. Bloggers and non-bloggers may enter. If you don’t want to leave your email address, please be sure to check back for my announcement on the winner. Please note that winners must respond within 48 hours of being announced/contacted or another winner will be drawn.

Want an extra entry? Do any or all of the following and receive an extra entry for each one. Be sure to leave me a separate comment for each additional entry.

Follow me on Pinterest

Follow me on Twitter and tweet the following (or something like it) “I just entered a #giveaway to win tax services from @hrblock @rockinmama ” Daily tweets are allowed but please leave the permalink in the comments section so I can easily keep track

Rockin’ Mama Facebook fans automatically receive an extra entry

Subscribe to my feed via email or reader.

Blog about this giveaway. It doesn’t have to be a separate post. Just include a blurb when you blog about other giveaways/promotions

Click on one of the cute buttons below and digg, stumble, fav, etc. Just let me know what you did in the comments section

No compensation was received for this post. H&R Block provided online tax filing services which helped facilitate the writing of this post.

Images: H&R Block

Quote Source: H&R Block

- Discover Luxury at Sonesta Irvine: Your Ideal Staycation - August 8, 2024

- CHOC Walk Returns to the Disneyland Resort – Special Events and Ways to Support - June 28, 2023

- Beastly Ball Returns to the Los Angeles Zoo - May 8, 2023

I learned that H&R Block professionals have prepared more than 550 million tax returns worldwide since 1955.

I follow you on Pinterest–http://pinterest.com/mami2jcn/

I follow you on Twitter and tweeted–https://twitter.com/mami2jcn/status/306760664024748033

I like you on Facebook as Mary Happymommy.

I subscribe to your email feed.

I clicked the like button on this post with my FB username, Mary Happymommy.

I clicked the G+1 button with my username, Mary F.

Shared on Facebook–https://www.facebook.com/mary.happymommy/posts/543279192369115

I learned that they have prepared alot of returns

twitter follower, jfwmass

email subscriber

I learned that their site has a FREE 2012 Tax Estimator!

I follow you on Pinterest.

I follow you and tweeted.

https://twitter.com/susanlanai/status/306969569698922498

I’m a Facebook Fan.

I’m an email subscriber.

I clicked on the g+1 button.

I learned that the H&R Block At Home Premium includes 1 state program!

I follow you on Pinterest (bokhyun).

I like you on Facebook!

I’m an email subscriber!

2/28 tweet–https://twitter.com/mami2jcn/status/307121139807834113

https://twitter.com/susanlanai/status/307353287336812545

3/1 tweet–https://twitter.com/mami2jcn/status/307482938872840192

https://twitter.com/susanlanai/status/307674746017939457

3/2 tweet–https://twitter.com/mami2jcn/status/307852857602879488

3/3 tweet–https://twitter.com/mami2jcn/status/308212461213982720

https://twitter.com/susanlanai/status/308344182064414720

3/4 tweet–https://twitter.com/mami2jcn/status/308570176960466944

https://twitter.com/susanlanai/status/308615428085780480

3/5 tweet–https://twitter.com/mami2jcn/status/308922341042290689

https://twitter.com/susanlanai/status/309197371940687872

I learned that H&R Block prepared more than 24 million tax returns worldwide in 2010!

Following you on Twitter and tweeted @Austieb7

https://twitter.com/Austieb7/status/309203603611058176

Liked Rockin’ Mama on Facebook as Austin Baroudi.

Subscribed to your feed via email.

Posted on my blog.

http://austieb7.blogspot.com/2013/03/httprockinmamanet2013026-things-you.html

Stumbled this giveaway.

http://www.stumbleupon.com/stumbler/austieb7/likes

3/6 tweet–https://twitter.com/mami2jcn/status/309291773962903552

https://twitter.com/susanlanai/status/309338152559063041

I Learned that after you’ve approved and paid for your completed tax return you’ll be able to download a PDF copy of your return from your online account.

I Follow you on pinterest(Kelly Saver)

I subscribe to your email under kellywcuATyahooDOTcom

I like you on FB(Kelly D Saver)

Daily tweet @Austieb7

https://twitter.com/Austieb7/status/309594857310138368

3/7 tweet–https://twitter.com/mami2jcn/status/309656819670851584

3/8 tweet–https://twitter.com/mami2jcn/status/310021933460754433

Daily tweet @Austieb7

https://twitter.com/Austieb7/status/310320495868403712

3/9 tweet–https://twitter.com/mami2jcn/status/310411342337175554

https://twitter.com/susanlanai/status/310431527622303744

Daily tweet @Austieb7

https://twitter.com/Austieb7/status/310805587778740227

https://twitter.com/susanlanai/status/311156203159957505

I learned that HR Block has prepared more than 550 million tax returns worldwide since 1955. Woah!

I follow you on pinterest /hockeyandbeer

TWeeted https://twitter.com/KristinePhot0_j/status/311174536831848448

I am a fan of rockin mama on fb (louly.mcbutter)

I subscribe to your blog w/ Google Reader

I pushed a cute clicky button and +1’d this post on G+

Daily tweet @Austieb7

https://twitter.com/Austieb7/status/311359903472160769

tweeted again https://twitter.com/KristinePhot0_j/status/311508446266667009

https://twitter.com/susanlanai/status/311521079992668160

https://twitter.com/susanlanai/status/311746000014413824

Your blog is amazing. You write about very interesting things. Thanks for all your tips and information

https://twitter.com/susanlanai/status/312365665967292416