{Sponsored}

Over the weekend, my son informed me that he’ll be moving to New York City…for college. After learning that a co-worker’s son had a job lined up for him after graduating from NYU, my son has set the bar high for his college future. And to be honest, I wouldn’t have it any other way. From the moment my kids started school, college has never been presented as an “option.” Both my son and daughter know that in order to achieve their dreams of being a scientist and a teacher, college is essential.

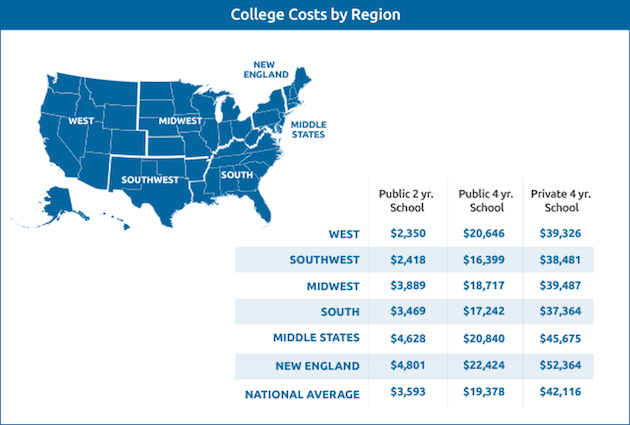

The Rising Cost of College

In just 8 years, my son will be headed to college. While that still seems like light years away, I’m already technically behind when it comes to saving for college. College debt is now the second highest consumer debt at 1.3 trillion dollars, behind mortgage debt. While I want my children to go to college, I don’t want either of them or myself to be left with an insurmountable financial burden.

In addition to the cost, it is important to consider that the number rises each year. You can get a general idea of how much it will cost to send your child to college by increasing the current costs 5% each year. Scholarshare has a simple chart that explains this further.

I opened ScholarShare 529 accounts for each of my children about a year ago to help ease the financial burden. The process was easier than I expected, and I was able to open an account for just $25 (per child). Remember that you don’t have to save 100% of your child’s college expenses. Financial aid, scholarships, and loans can also mitigate the cost of a college education.

Ways to Save For College

When I first started thinking about saving for college, I was overwhelmed with the amount of time I have compared to the cost for each of my children. Thankfully, there are a number of ways parents can pay for college. These include a ScholarShare 529 account, a Roth and/or Traditional IRA, Scholarships, Educational Savings Bonds, Financial Aid and Student Loans. A ScholarShare College Savings Account can be used at US-accredited colleges and universities and certain colleges abroad. There is no federal or state income tax on withdrawals, as long as the money is used for qualified expenses including tuition and fees, books, and some room/board. If your child does not go to college, the funds can be transferred to an eligible family member. Any US citizen with a social security number of taxpayer identification number can open a ScholarShare Account with a minimum of $25. Family members can also open an account as a gift or contribute their gift to an existing account. There are no account maintenance fees or income limitations and as long as the money is used for college expenses, it is not lost or taxed.

Reduce the Overall Cost of College

Despite the daunting costs associated with a college education, there are a number of ways to lower the overall financial impact. Ideally, you’ll want to save as opposed to borrowing money that will then have to be repaid with interest. Additionally, beginning with a community college can help decrease overall costs as well as opting for public v. private universities and staying in-state.

529 Crib Notes: A College Savings Webinar Featuring Rosie Pope

This Thursday, May 18th, ScholarShare will host a 30-minute webinar with Author/Fashion Designer Rosie Pope and Garianne Dashiell. During the webinar, Pope and Dashiell will walk you through 529 plans, how they work and the most important things to consider when selecting a plan. You will also have the opportunity to ask questions live during the webinar.

Register for the webinar here.

National 529 Day (May 29th, 2017)

To propel you on your child’s college savings plan, ScholarShare will offer a three-day promotion May 24th-26th, 2017. When you open a ScholarShare 529 account during this time, ScholarShare will provide a matching deposit of $50. To be eligible for this promotion, you must open a new ScholarShare account between May 24th and May 26th with a minimum of $50 plus sign up for $25 Automatic Contribution Plan for six months. The matching deposit will be received on or before January 18th, 2018. For details, terms and conditions, visit ScholarShare.com/529Day.

California ScholarShare Events

Families can connect with ScholarShare at their local events, which have included presence at the LA Zoo, the New Children’s Museum in San Diego and the Oakland Zoo. For information about ScholarShare’s National 529 events, visit their website. You can also connect with ScholarShare on Facebook and Twitter.

- Discover Luxury at Sonesta Irvine: Your Ideal Staycation - August 8, 2024

- CHOC Walk Returns to the Disneyland Resort – Special Events and Ways to Support - June 28, 2023

- Beastly Ball Returns to the Los Angeles Zoo - May 8, 2023

Leave a Reply