{Sponsored}

As technology continues to evolve, I find myself doing a large portion of my daily tasks online or via my smart phone. Five years ago, I never imagined I would be making deposits into my checking account with my iPhone, and admittedly, I was a late adopter. But having the ability to scan a check and have it deposited directly into my bank account is invaluable since I can eliminate the weekly (and often more frequent) trips to our local bank.

With the opening of any bank account comes non-negotiable fees. In fact, just recently I asked my local bank if there was a way to reverse the monthly charges that I have been incurring for failure to maintain a monthly prescribed balance (which is quite high, mind you). I’m not one to overdraft my account thanks to my Type A personality, but the fees are at least $35 for a single occurrence, which can quickly add up.

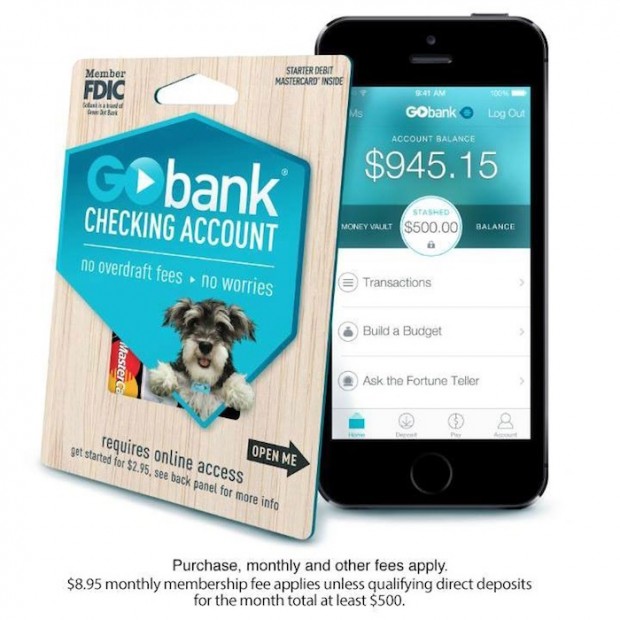

GoBank is a brand new checking account, designed specifically for people on-the-go. Unlike many checking accounts, GoBank doesn’t charge overdraft fees or penalize for not maintaing an ongoing minimum balance. Value, ease-of-use, and on-the-go access are essential in our fast-paced era which is why GoBank is a smart choice. GoBank makes it easy to do everything from your smart phone and you have the option of opening an account and depositing cash inside your local Walmart.

Image: GoBank

How do I get started with GoBank?

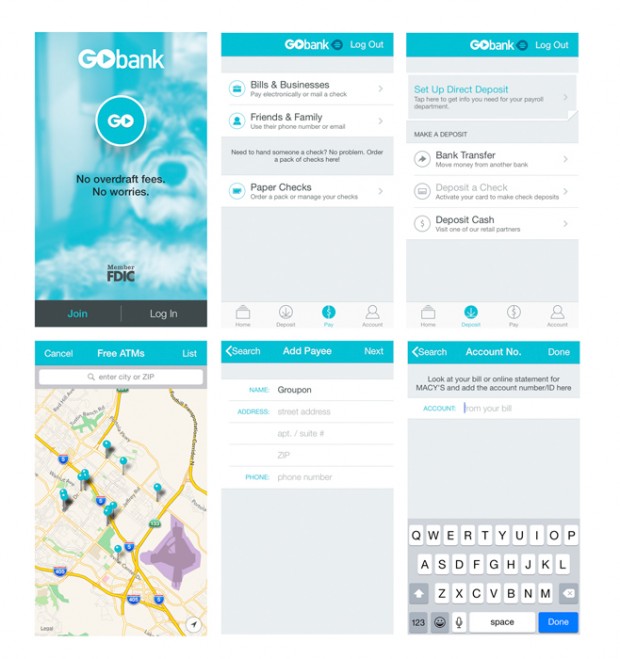

Once I picked up a starter kit from my local Walmart, I was able to complete the short sign-up process online from home. You can also sign up for a GoBank account online at GoBank.com or by downloading their app. You will be asked for some basic identifying information including your social security number. Once you’ve made your initial deposit, you can begin banking immediately. You’ll also receive a personalized debit card within 2 weeks of opening your account.

What are the advantages of using GoBank?

Perhaps the most compelling feature of this online mobile banking service is its ease of use. It took minutes to set up my account and I can do practically everything from the app including bill pay, photo check deposits, and person-to-person payments. There are over 42,000 free ATMs across the country, and within my own area I found at least 7 located within 5 minutes of my home. If you use an ATM outside of their network, a $2.50 will apply plus any fee the ATM owner may access, so they encourage you to use the free ones!

What does it really cost to use GoBank?

Even though GoBank isn’t technically free, the price structure is straight forward and incredibly affordable. Here is the fee breakdown:

- Starter Kit: $2.95 with an initial deposit of at least $20 (Or sign up at GoBank.com or with the app for free with an initial deposit of at least $50.)

- Monthly Membership Fee: $8.95. This fee is waived if you set up a qualifying direct deposit of $500 per month.

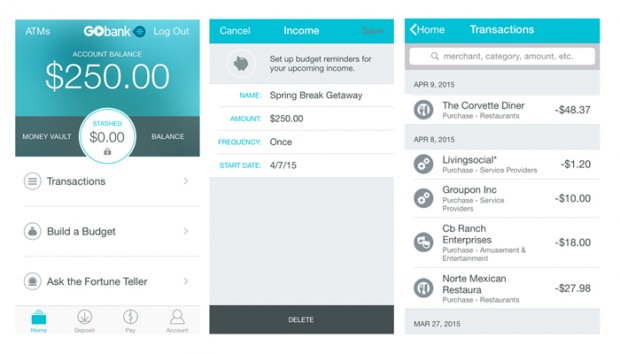

Since our family is always on-the-go and we love to travel, I decided to utilize my new GoBank debit card to plan and budget our recent Spring Break Getaway. With just one week of downtime, I thought a stay cation in San Diego would be idyllic, given it’s proximity and sublime weather. I had already booked our hotel and rental car since I knew that I could stick with a budget depending on the level of accommodations and the size of the car we needed. Budgeting for food and activities is our challenge I’ve often overspent on vacations, a fact only realized once we were home and the vacation but a distant memory. Without any visual reference, I’ve often found myself spending a significant amount of money on coffee, snacks, and last-minute, unplanned activities, all of which add up quickly.

Image: GoBank

Utilizing GoBank’s free mobile app, I set a budget of $250 for food and activities for our 3-day getaway (for the 3 of us). Additionally, I made a list of potential activities and restaurants and utilized Groupon and LivingSocial for discounts when applicable. This allowed us to get the most value out of our mini getaway without going over the $250. I mentally divided the money into 3 days and referenced the app every single time I made a purchase, since the transactions appear in real-time almost immediately after the debit card is swiped. I also liked the ability to check my transaction history to ensure that my receipts matched up with those listed on the app.

Like many people, I have credit cards, debit cards, checks, and a myriad of other ways to pay. In order for this to be successful, I had to commit to using my GoBank debit card for every single transaction including parking and entrance fees to state parks and beaches. This didn’t present a challenge as I found that every single establishment we visited accepted my GoBank card including online businesses and even parking meters. You can use your GoBank debit card everywhere MasterCard is accepted. There is a 3% charge for purchases from foreign websites and merchants, FYI.

At the end of our stay cation, I still had $15 left! So how did we do it? Here are my best tips for budgeting your next vacation getaway!

1. Start a vacation fund. If you know where and when you want to travel, begin saving as soon as you are able and involve your kids. It might be as simple as setting aside the equivalent of your daily Starbucks run each day or having your kids put in a portion of their allowance. Use something visible and tangible so that your family can see your progress and get excited about the upcoming trip.

2. Reference deal sites for everything. Groupon, LivingSocial, and Goldstar are my go-to resources for finding ice cream, massages, museum tickets, and even accommodations. With time and planning, you can save a ton of money on food, activities and so much more. If the venue you’re aspiring to visit is not listed on one of these sites, remember to do a quick Google search for online discounts or utilize your AAA card.

3. Travel during off-peak seasons. Our most recent trip to San Diego was booked during their shoulder season and we knew that it could be cold and even rain. However, because San Diego also offers many exciting indoor attractions for kids, we knew that we would enjoy our trip even if it rained the entire time. Interestingly enough, we swam 2 out of the 3 days during the trip and spent much of our time outside at local parks and outdoor museums.

4. Go beyond the tourist attractions. One of our best mornings was spent at the Maritime Museum of San Diego, which is a lesser known but highly intriguing attraction. We easily could have spent half a day exploring these historic oceanic vessels.

5. Look for free activities in your destination city. If you conduct an online search for “free things to do” in the city you’re visiting, you’ll likely come up with a list you won’t be able to complete in one trip. For example, the San Diego Tourism Authority has a list of 25 Fun & Free Things to Do which we referenced for parks and outdoor spaces in the surrounding area. Be sure to check out your destination’s walking tours which often give you a nice overview of the city and can be very inexpensive or even free.

For more information about GoBank or to set up an account, visit GoBank.com.

- Discover Luxury at Sonesta Irvine: Your Ideal Staycation - August 8, 2024

- CHOC Walk Returns to the Disneyland Resort – Special Events and Ways to Support - June 28, 2023

- Beastly Ball Returns to the Los Angeles Zoo - May 8, 2023

Leave a Reply