As disciplined as I am when it comes to saving and spending money, even I can fall into the shopping craze that characterizes this time of year. We are a family that strives to be debt-free with the exception of a mortgage and car payment, thus we don’t own many credit cards. In fact, we literally use one credit card for over 90% of our purchases in order to keep track of our expenses and we pay it off each and every month.

What if you find yourself in a situation where you cannot or will not open a credit card account? What alternative is there to debit cards which often have added fees for nearly everything including over-drafting your account? While we have a debit card, I rarely use it because I honestly like the cushion of having a month to pay off whatever I am spending, as opposed to having it pulled directly from my account at the time of purchase. I realize that this may not work for those who don’t pay off their credit card bill each month which is why Bluebird by American Express is a practical alternative to credit and debit cards.

Last month I introduced you to the new service by American Express and Walmart and the biggest benefit I see personally for our family is the ability to curb spending. What better way to test it out then during the holiday season?

After you’ve received your card (either online, which is free or in Walmart stores which costs $5), you’ll want to register your card and begin setting up your account. One very important thing to note is that if you have a Serve card (which I did), you won’t be able to apply or register your Bluebird card until you close that account. I initially had some difficulty figuring out why I could not apply for a free account and eventually learned this was the reason.

Registering is easy and only took a few minutes, but you’ll have to input your social security number. You can then begin adding funds to your card in one of three ways:

1. Direct deposit

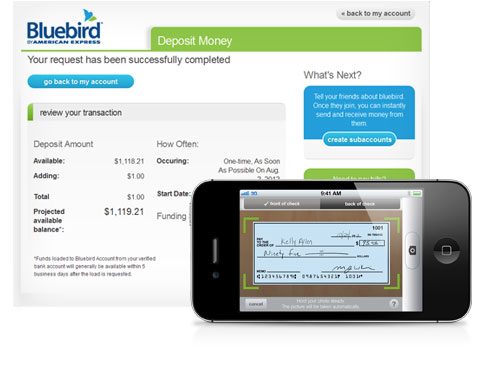

2. Checking or savings account

3. Cash (must do this in Walmart stores)

Since we tend to keep everything online, I linked the card to a checking account to fund it and this worked well. Budget how much you want to spend for the week (or month), fund the card, and when the funds are gone, spending is curbed. Obviously this would take discipline, but it’s one practical way during the holiday season to avoid impulse purchases.

I have to admit that I’m not one to readily try out a new type of service such as this one, but I felt very comfortable knowing that Bluebird is backed by Walmart and American Express. Because Bluebird is brought to you by American Express, the card can be used anywhere you would normally use an AMEX card. You simply swipe it like a credit card to make a purchase.

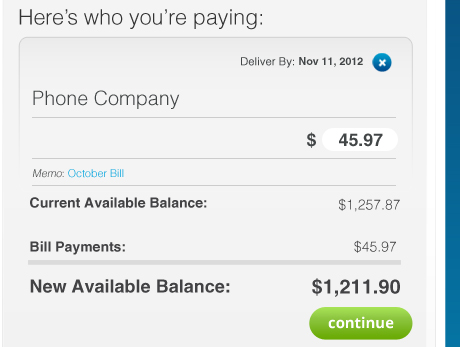

Some of the other ways you can use Bluebird (which I have not tried yet) include paying bills online or via their mobile app and cash withdrawals without fees or surcharges. You can also create sub-accounts for family members to further manage expenses.

Overall, we’ve had a very positive experience with Bluebird by American Express. I like that the fees are very minimal, the card is globally accepted as an American Express card, and that I can manage my account online or via the mobile app. Additionally as a member, Bluebird offers fraud and purchase protection, Global Assist Services, Roadside Assistance and even Entertainment Access.

To sign up for a Bluebird account, visit your local Walmart store or visit them online.

I participate in the Walmart Moms Program and am compensated for my time and honest opinions.

- Discover Luxury at Sonesta Irvine: Your Ideal Staycation - August 8, 2024

- CHOC Walk Returns to the Disneyland Resort – Special Events and Ways to Support - June 28, 2023

- Beastly Ball Returns to the Los Angeles Zoo - May 8, 2023

Leave a Reply