{Sponsored}

Health care costs are on everyone’s minds these days. It’s always been on my mother’s, too. One of my her important life lessons was to prioritize my health. She modeled healthy eating habits, opting for home-cooked meals over fast food and I secured my first gym membership as a teenager. Every year I went to the doctor without fail, a habit I’ve continued with my own family. As I selected my first insurance plan through my job, she reminded me that like most things in life, you get what you pay for. Lowering my health care costs is something I work on regularly. If you are looking for ways to reduce this expense, here are some helpful tips.

7 Ways to Lower Your Health Care Costs

- Prevention is key. Like so many other issues in life, it is easier (and more affordable) to prevent a problem than it is to treat it. Many insurance companies cover preventive services as part of their plans. This can include recommended screenings, immunizations, and tests, depending on your age, family history and overall health. Your own efforts to live a healthy lifestyle, such as consuming a healthy diet and staying active can help prevent certain diseases – i.e. diabetes, heart disease, hypertension – which can, in turn, lower your health care costs.

- Pay attention to your health. A clean bill of health at your annual physical does not mean you should wait a year to perform recommended self exams. Many women have found breast cancer in its early stages through monthly self-exams.

- Shop around. If you are looking to secure or change insurance plans, be sure to compare providers and plans. To lower your health care costs, you might also consider a high deductible plan, which may be more affordable in the long run if you only visit your physician once or twice a year. If you already have an insurance plan, be sure to visit your provider’s website to compare prices on tests and procedures using their online tool.

- Consider doctor and hospital alternatives. If you need to see a doctor for a minor illness or injury, you might consider visiting a local walk-in clinic or urgent care. Many insurance plans cover these types of services and you can often get in sooner than a visit with your regular physician. Avoid using the emergency room for anything other than an emergency, as these visits tend to be the most costly.

- Review your billing statements. Just this month, I received a phone call about an overage charge from an urgent care visit. Medical personnel are not exempt from errors, so be sure to look over your bills and call for any concerns or discrepancies.

- Use a flexible spending account. If your employer offers an FSA, you should take advantage of the tax savings available. To use an FSA, simply set aside the amount of money you believe you will spend on medical expenses in a year. This will lower your taxable income, however, you must use all of the money you have set aside or you will lose it.

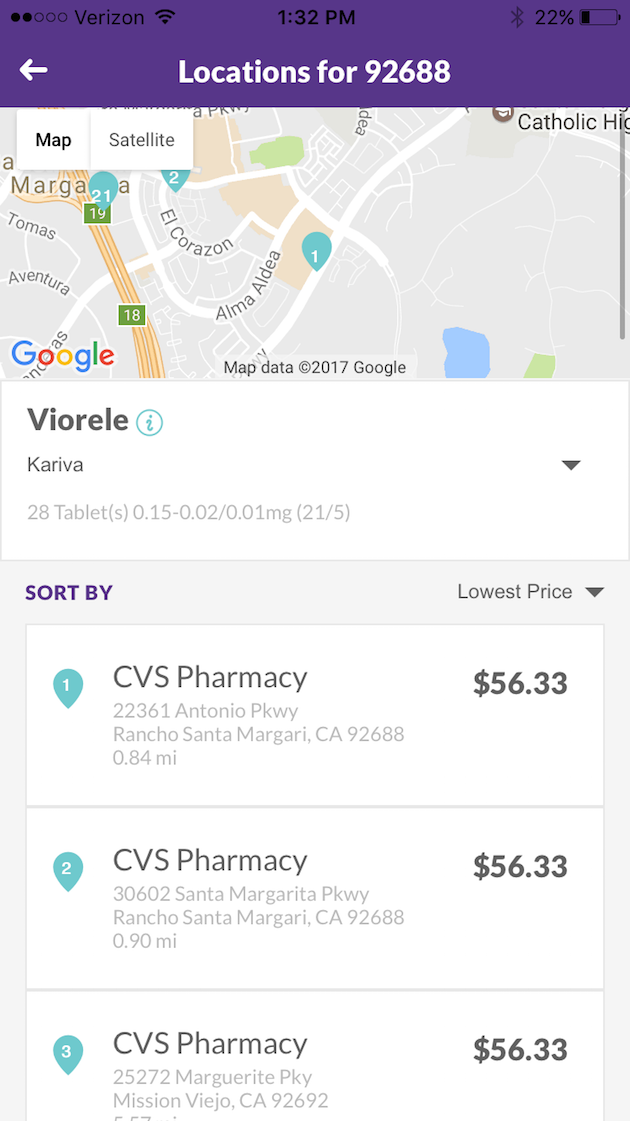

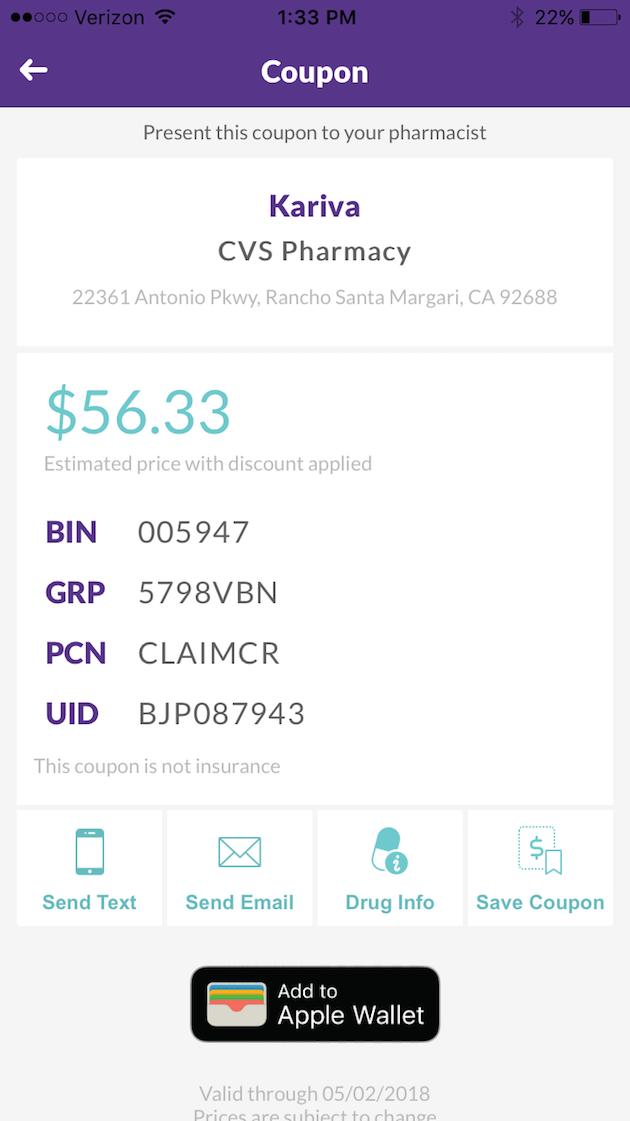

- Save on prescription medications. There are a number of ways to save on prescription medications. Ask your physician if a generic medication will suffice. You can also participate in your insurance provider’s mail order program, which reduces the cost of each medication since you are sent a few month’s supply at one time. Get the best prices on over 50,000 prescription drugs using SearchRX. You can either search their database and pharmacy price checker online or via the app for the lowest discounted price. Once you’ve found the best local pharmacy price, simply print out, email or receive your prescription coupon via text message to present to your pharmacy during check out.

Discounts on prescription medications are available to all US residents without the cost of a deductible, claim forms, limitations or maximums. Use the coupon as often as you need to, without any limit to how much you can save. Similarly, you won’t be excluded from these discounts if you have a pre-existing condition.

I recently conducted a search for the hormonal medication I am required to take each month and found that my local Rite Aid offers the lowest price. Searching was incredibly easy, and once I found the medication at my local pharmacy, I sent the coupon to my phone to be used when I pick up my prescription.

There are so many things I could do with the money I save on health care each month. To begin saving money on prescription medications, visit SearchRX.com or download their free app available on iTunes and Google Play.

- Discover Luxury at Sonesta Irvine: Your Ideal Staycation - August 8, 2024

- CHOC Walk Returns to the Disneyland Resort – Special Events and Ways to Support - June 28, 2023

- Beastly Ball Returns to the Los Angeles Zoo - May 8, 2023

Leave a Reply